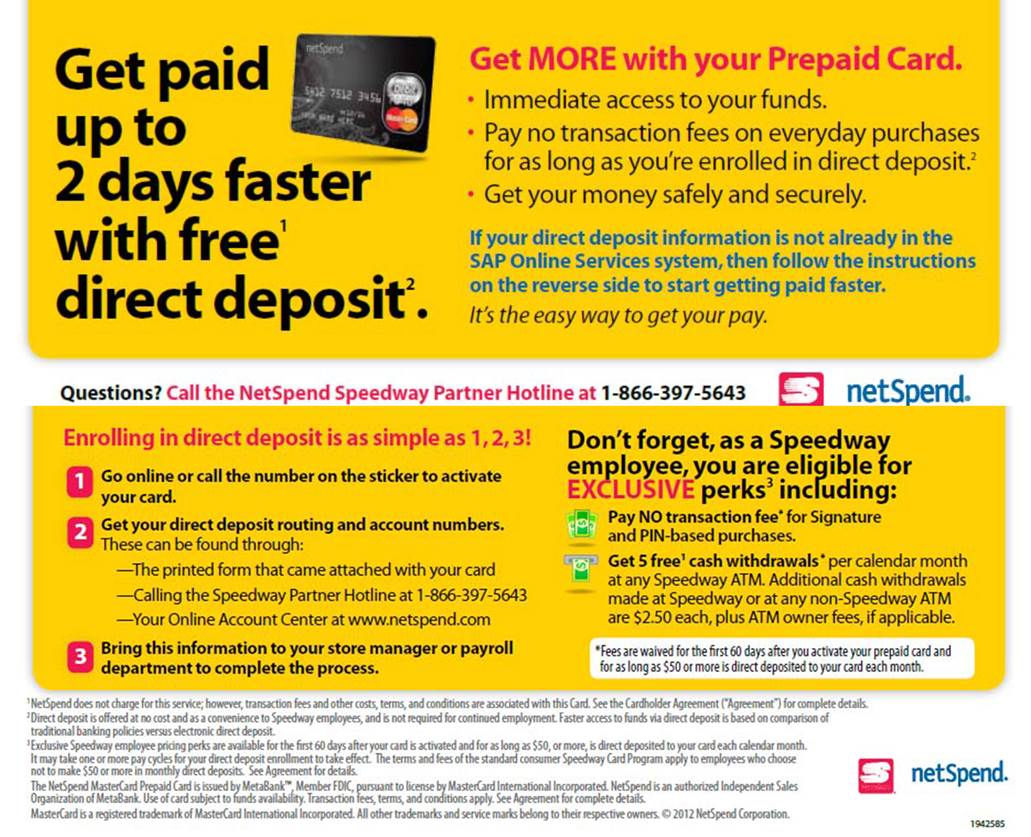

From the perspective of consumers, the whole purpose of prepaid debit cards – their reason for living, if you will – is to give consumers immediate access to their money. Those cards are an especially important financial lifeline for people who don’t have traditional bank accounts. In pitching its reloadable prepaid cards, NetSpend Corporation promised consumers “immediate access” to their funds with “no holds, no waiting.” But according to an FTC complaint, the defendants’ business practices rendered that claim and other representations deceptive.

“Immediate access”? Not so fast, alleges the FTC. NetSpend’s ads were replete with claims like “No Waiting!” and “Use your card immediately.” But the FTC says many consumers experienced delays in accessing their funds both in the initial activation process and later. For example, despite the company’s “use it today” claim, consumers have to go through an identity verification process required by law before the prepaid debit card can be activated – a process with requirements many people have difficulty satisfying.

“Immediate access”? Not so fast, alleges the FTC. NetSpend’s ads were replete with claims like “No Waiting!” and “Use your card immediately.” But the FTC says many consumers experienced delays in accessing their funds both in the initial activation process and later. For example, despite the company’s “use it today” claim, consumers have to go through an identity verification process required by law before the prepaid debit card can be activated – a process with requirements many people have difficulty satisfying.

The upshot? People who loaded funds onto NetSpend cards often had to wait – and wait and wait – to access their own hard-earned money. The FTC says those delays resulted in severe financial hardship to consumers, including evictions, repossessed cars, and late fees on bills.

The complaint also alleges that many customers who closed their accounts and asked for refunds had to wait several weeks to get their money back. In other cases, NetSpend imposed fees that depleted the funds from cards after consumers were unable to activate them.

The complaint takes on other instances in which NetSpend’s business practices were at odds with its marketing claims. For example, the lawsuit challenges as misleading NetSpend’s representation that consumers are “guaranteed approval” for a card. The FTC also alleges that NetSpend said it would grant provisional credit when consumers dispute charges on their cards, but often failed to live up to that promise.

The lawsuit was filed in federal court in Atlanta. If you work in the financial services sector or have clients interested in alternative payment methods, this is a case to watch.

In reply to Need to know were I can file by Eartha brown

In reply to I HAVE ALWAYS HAD PROBLEMS by WILLIAM M PEARSON

In reply to They Closed my account after by KJ

In reply to I HAVE ALWAYS HAD PROBLEMS by WILLIAM M PEARSON

In reply to This company has frauded me by Kim pettit

In reply to Need to know were I can file by Eartha brown

In reply to Need to know were I can file by Eartha brown

In reply to The courthouse. That is by john deauxx

In reply to Need to know were I can file by Eartha brown

In reply to I also would like information by Nicole

The FTC doesn't handle individual cases, but you can report problems you have with a business to the FTC. Go to www.FTC.gov/Complaint to report a problem. The information you give goes into a secure database that the FTC and other law enforcement agencies use for investigations. You can also contact your state attorney general; use this list of state attorneys general to find yours.

In reply to Need to know were I can file by Eartha brown

In reply to Need to know were I can file by Eartha brown

In reply to Need to know were I can file by Eartha brown

In reply to I wasnt able to get my money by Dale kerr

In reply to I have bought several cards by Curtis Bloodworth

In reply to we did not get our credit by Manjunath Ramaswamy

In reply to we did not get our credit by Manjunath Ramaswamy

In reply to I too want to know how to get by Skylar Ward

The FTC just filed the lawsuit, Skylar. The case hasn't gone to trial yet. But if you visit ftc.gov regularly or subscribe to the blogs, you'll find out about any updates.

In reply to I bought a prepaid netspend by Sharlotte E Ta…

Pagination