It’s a given that companies shouldn’t charge consumers hidden fees. But it raises a particular concern when an online lender makes “No Hidden Fees” claims a centerpiece of its marketing – and then deducts from those loans hundreds or even thousands of dollars in hidden up-front fees.

According to a lawsuit filed by the FTC,  Lending Club, which bills itself as “the world’s largest online marketplace connecting borrowers and investors,” attracts prospective borrowers with direct mail pieces, online ads, and even paid blog posts touting that the loans come with “no hidden fees.” For example, as a Lending Club-created paid-for post on a credit website promises, “Once you’re approved, your money goes straight into your account, with no hidden fees.” But as the complaint alleges, consumers are in for a surprise when they learn that what goes “straight into [their] account” is not the total represented during the online application process as the “Loan Amount.” Instead, what they get is an amount reduced by hundreds or thousands of dollars. That’s because Lending Club takes a hefty portion of the Loan Amount up front as an origination fee.

Lending Club, which bills itself as “the world’s largest online marketplace connecting borrowers and investors,” attracts prospective borrowers with direct mail pieces, online ads, and even paid blog posts touting that the loans come with “no hidden fees.” For example, as a Lending Club-created paid-for post on a credit website promises, “Once you’re approved, your money goes straight into your account, with no hidden fees.” But as the complaint alleges, consumers are in for a surprise when they learn that what goes “straight into [their] account” is not the total represented during the online application process as the “Loan Amount.” Instead, what they get is an amount reduced by hundreds or thousands of dollars. That’s because Lending Club takes a hefty portion of the Loan Amount up front as an origination fee.

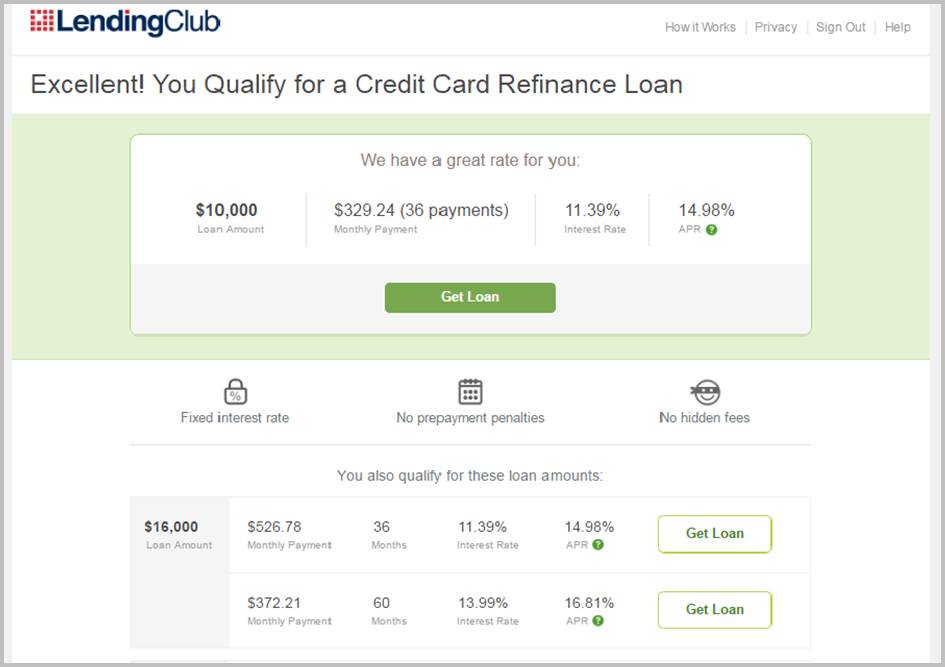

You’ll want to read the complaint and see the accompanying visuals to get a feel for what the transaction looks like from the consumer’s perspective. But the FTC alleges that on both computers and smartphones, what little information Lending Club offers about the up-front charge is hidden, often behind obscure hyperlinks or sandwiched between lines of “below the fold” text.

A ccording to the lawsuit, in response to consumer concerns about the undisclosed or inadequately disclosed up-front charge, the company’s own quarterly complaint reviews have proposed “highlighting [the] origination fee.” According to one in-house compliance review, “The origination fee is disclosed on the offer page tooltip” – a small green-and-white hyperlinked question mark – “but is not readily apparent unless an applicant clicks on the tooltip. This omission could be perceived as deceptive as it is likely to mislead the consumer.” One of Lending Club’s largest investors warned the company that the fee “is not clear and conspicuous and could be subject to a UDAAP claim,” referring, of course, to unfair or deceptive acts or practices. In addition, the FTC says the investor’s legal counsel told Lending Club that despite the company’s prominent “no hidden fees” claim, “the documents we reviewed contain a large ($300 to $450) origination fee that only appears once” in “relative obscurity” – a practice the person said could result in law enforcement action.

ccording to the lawsuit, in response to consumer concerns about the undisclosed or inadequately disclosed up-front charge, the company’s own quarterly complaint reviews have proposed “highlighting [the] origination fee.” According to one in-house compliance review, “The origination fee is disclosed on the offer page tooltip” – a small green-and-white hyperlinked question mark – “but is not readily apparent unless an applicant clicks on the tooltip. This omission could be perceived as deceptive as it is likely to mislead the consumer.” One of Lending Club’s largest investors warned the company that the fee “is not clear and conspicuous and could be subject to a UDAAP claim,” referring, of course, to unfair or deceptive acts or practices. In addition, the FTC says the investor’s legal counsel told Lending Club that despite the company’s prominent “no hidden fees” claim, “the documents we reviewed contain a large ($300 to $450) origination fee that only appears once” in “relative obscurity” – a practice the person said could result in law enforcement action.

Did the company respond to those warnings? No, alleges the FTC. According to the complaint, “Rather than improving over time, [Lending Club’s] violations have become more egregious over the years,” with the company increasing the prominence of the “no hidden fees” claim and decreasing the already small, hyperlinked tooltip.

Those allegations relate only to the first of four counts charged in the lawsuit. Regarding Count II of the complaint, Lending Club engages in a two-step review process. The FTC alleges that the company has told consumers things like “Great news! Investors have backed your loan 100%!” when there were still additional hurdles prospective borrowers had to vault, including a stringent second credit review that many people can’t meet. As a result, the FTC says some prospective borrowers who got those congratulatory messages were ultimately rejected, rendering the company’s claims deceptive.

Count III of the complaint alleges that in numerous instances, Lending Club has made unauthorized withdrawals from consumers’ bank accounts – for example, by charging borrowers double payments in a single month, by continuing to make withdrawals from consumers who have paid off their loans, or by taking money from accounts when consumers have told Lending Club they want to pay by check or by a different account. The upshot of the allegedly unfair practice: for some borrowers, unexpected overdraft fees. The complaint also alleges violations of the Gramm-Leach-Bliley Privacy Rule and Regulation P.

The FTC filed the case in federal court in California, but even at this early stage, the complaint is a reminder of how important it is for consumers to have accurate information from lenders – including online marketplace lenders.