Personal finance app Bridge It – consumers may know the company as Brigit – promised that people could get cash advances of up to $250 “within seconds” and with no “hidden fees.” But the FTC alleges that for many consumers, Brigit was a bridge to false promises, extra charges, and dark patterns that made it easy to sign up for its $9.99 per month membership, but hard to cancel. In addition to an $18 million financial remedy, the proposed settlement will require the company to bridge the gap between its promises and its practices.

Brigit offers a free version that alerts people when their account balance is low, but it was Brigit’s “Plus” plan that caught the eye of many consumers living paycheck to paycheck. “Plus” membership costs $9.99 per month, which the company debited directly from consumers’ bank accounts and automatically renewed until the person canceled. One of the real draws of membership was Brigit’s claims that members could “Get up to $250 whenever you need it.”

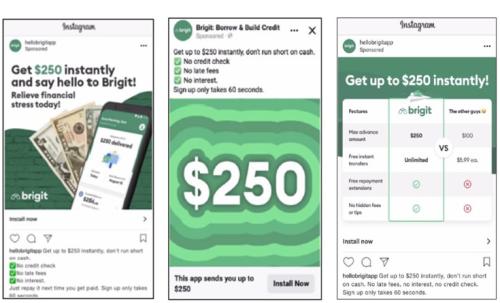

According to Brigit’s promotions, including on Instagram and Facebook, “Plus” members could get cash advances “instantly,” “quickly,” and “ASAP.” What’s more, the company claimed to offer “free instant transfers” with “no interest” and “no late fees.” “Just repay it next time you get paid,” said Brigit. The company also promised that unlike “the other guys,” Brigit charged “no hidden fees” and no “processing fees,” featured no fine print, and offered “free repayment extensions.”

Other ads on social media featured the reassuring message, “Whether you need money for bills or emergencies, we’ve got you covered.” Some promised “Get up to $250 instantly” and “This app sends you up to $250” illustrated with a large colorful image of “$250.”

That’s what Brigit told consumers, but the FTC says that lurking under the bridge were multiple forms of deception and unfairness. According to the complaint, “Despite Brigit’s numerous prominent claims that it will provide cash advances of up to $250, few consumers receive anything close to that amount, if they receive anything at all. In fact, only approximately 1% of Brigit Plus customers have received access to $250, and approximately 20% have been denied access to cash advances entirely.”

The FTC also alleges that despite Brigit’s promises of “instant” transfers and “no hidden fees,” in June 2022 the company began to charge consumers $.99 to get cash advances immediately. Otherwise people had to wait up to three business days to get money Brigit promised would arrive “instantly” or “in seconds.” Furthermore, the complaint charges that Brigit didn’t disclose that fee anywhere in its advertising, enrollment materials, or even its terms of service. Consumers found out about it only after they had asked for a cash advance.

What if consumers wanted to stop paying the monthly charge for Plus membership? You’ll want to read the complaint for details, but the FTC says Brigit employed a series of dark patterns to make it difficult for people to cancel. Indeed, for people who wanted to change their enrollment, the first and most prominent option Brigit presented them was to “Stay on Plus plan.” After that, the FTC says Brigit required them to navigate through a variety of screens, additional offers, and even a multiple choice survey, rather than just honoring their request.

Many consumers complained to Brigit that they had difficulty cancelling their accounts. Even the company’s employees reported that its burdensome cancellation procedure was “making a lot of people angry in the name of retention,” and that it “doesn’t align” with Brigit’s “values of simplicity and transparency.” According to the complaint, statements from other employees offer insights into why the company was slow to change its practices. For example, Brigit allegedly removed consumers’ ability to cancel a membership within the mobile app to “increase friction to delete” and added the required survey to “reduce user churn” by “adding friction” to the deactivation flow. A corporate document says that, to “stop leakage” after Brigit reduced advance amounts, the company changed to a light gray color the text consumers had to click to unsubscribe.

The FTC says Brigit’s cancellation practices proved especially injurious to people who owed money. Although Brigit advertised that Plus members could “cancel anytime,” that the company “won’t ding you if you need more time to pay it back,” and that consumers won’t “get locked into layers of subscriptions,” Brigit didn’t allow Plus members who had an outstanding cash advance to stop the recurring $9.99 monthly fee. As the complaint alleges, “This means that Plus members are locked into paying $9.99 per month indefinitely until they repay an advance. Some customers reported incurring monthly charges against their will for over a year while they were unable to cancel their account due to an outstanding advance. For a $250 cash advance, this monthly fee is equivalent to a finance charge of more than 48%, and for a $100 cash advance, it is equivalent to a finance charge of more than 121%.”

The complaint alleges that Brigit violated the FTC Act by making deceptive claims that consumers could get cash advances of up to $250, that consumers could get them instantly for no extra fees, and that consumers could cancel anytime, and also by unfairly charging consumers without their consent. The FTC says Brigit also violated the Restore Online Shoppers’ Confidence Act (ROSCA) by not clearly and conspicuously disclosing material terms of its product.

In addition to the $18 million financial remedy, the proposed settlement includes provisions to protect consumers in the future, including that Brigit must make required disclosures about negative options, must get consumers’ express informed consent before enrolling them in a negative option program, and must provide a simple mechanism to cancel.

Businesses can glean three key compliance points from the FTC’s action against Brigit.

Apps like Brigit may be new, but established consumer protection principles apply. Companies are offering consumers innovative financial products, but don’t think for a minute that the newness of the service will excuse unfair or deceptive practices. For example, despite attractive claims like “no interest” or “cancel anytime,” when people were struggling to pay back what they owed, Brigit continued to charge them the $9.99 monthly membership fee, making it even more difficult for people to escape the debt vortex.

The FTC will continue to shed light on dark patterns. Subjecting consumers to deceptive design tricks, confusing navigation, and exhausting “save” strategies can run afoul of the FTC Act. The FTC couldn’t be clearer that illegal dark patterns are on its law enforcement radar screen.

Is it time for a ROSCA rethink at your company? Companies that sell products or services online using negative options must comply with protections of ROSCA. When conducting a ROSCA compliance check, consider – among other things – what your customers are telling you about possibly deceptive claims, confusing terms and conditions, unauthorized charges, and hurdles to cancellation.

It is your choice whether to submit a comment. If you do, you must create a user name, or we will not post your comment. The Federal Trade Commission Act authorizes this information collection for purposes of managing online comments. Comments and user names are part of the Federal Trade Commission’s (FTC) public records system, and user names also are part of the FTC’s computer user records system. We may routinely use these records as described in the FTC’s Privacy Act system notices. For more information on how the FTC handles information that we collect, please read our privacy policy.

The purpose of this blog and its comments section is to inform readers about Federal Trade Commission activity, and share information to help them avoid, report, and recover from fraud, scams, and bad business practices. Your thoughts, ideas, and concerns are welcome, and we encourage comments. But keep in mind, this is a moderated blog. We review all comments before they are posted, and we won’t post comments that don’t comply with our commenting policy. We expect commenters to treat each other and the blog writers with respect.

We don't edit comments to remove objectionable content, so please ensure that your comment contains none of the above. The comments posted on this blog become part of the public domain. To protect your privacy and the privacy of other people, please do not include personal information. Opinions in comments that appear in this blog belong to the individuals who expressed them. They do not belong to or represent views of the Federal Trade Commission.

Cool, I've been looking for this one for a long time

I like this idea, I completely with you agree.

I find that the interest rate, is extremely high, along with the monthly fee. It is very difficult to close this account. Technically, I was given 600.00 but, only allowed “the highest amount I received was 50-60.00 dollars which was paid automatically. So basically you are paying off a loan early, you never actually used.

What does the FTC have planned in the very near future to stop all the mislreading and patently false commercial advertisement on YouTube, Facebook. etc. ?? Please restore our faith in your department. Thank you.

In reply to What does the FTC have… by Douglas R Garrett

How disappointing that I signed up, I chose not to get a Loan and I attempted to cancel before the cancellation date. I am just learning now that there is $19.99 charge to cancel. How disappointing! Brigit is so deceptive and disappointing.

I wasn’t approved for a loan and was charged $8.99. When I called to inquire what the fee was for their services. I canceled the service and they still billed me the $8.99. This is a ripoff.

Thank you for this informative article. People living on smaller wages or Soc sec disability or a surviving spouse, see these Brigit ads and say, "Wow, I could really use that money to catch up on some things and maybe treat myself to an iceream! LThen, all of a sudden they are in a whirlwind of fees and high interest rates! Their balance may not even be that high, but now the $9.99 charge keeps adding up and they meeded it to pay on the loan.

People want to have the piece of mind that the mothly charges will stop when they cancel, and it should be a simple process. Preying on and ripping people off who are desperate enough to take out a $250 loan in the first place is pathetic. Also, all free trials that are ending should have to notify the consumer 3 days prior to it ending, before they can start charging the regular price.