We usually wait until the end of a Business Blog post before offering a compliance pointer or two. But this time let’s lead off with two lessons that companies can learn from the FTC’s record-setting $3.17 million settlement with home and kitchenware company Williams-Sonoma. First, don’t make deceptive Made in USA claims. Second, once you sign an FTC order settling charges that you falsely advertised foreign-made items as Made in USA, don’t make those same misrepresentations again.

In 2020 the FTC alleged that Williams-Sonoma made a variety of misleading Made in USA claims on its website and in its catalog. For example, in promoting its Goldtouch Bakeware, the company described the collection as “Made in the USA” and “Made in America.” Williams-Sonoma also advertised some of its Rejuvenation products as “Made Right in America,” and “Made in the USA.” And certain pieces of upholstered furniture sold under the Pottery Barn Teen and Pottery Barn Kids brands were marketed as “Made in America.”

As the FTC’s 2020 complaint charged, in many cases, those products were wholly imported from abroad or incorporated significant imported materials, rendering Williams-Sonoma’s claims deceptive and resulting in a $1 million financial judgment. Tracking the FTC’s long-standing Enforcement Policy Statement on U.S. Origin Claims, the order in that case prohibited Made in USA claims unless the company could prove that:

A. The final assembly or processing of the product occurs in the United States, all significant processing that goes into the product occurs in the United States, and all or virtually all ingredients or components of the product are made and sourced in the United States; or

B. A Clear and Conspicuous qualification appears immediately adjacent to the representation that accurately conveys the extent to which the product contains foreign parts, ingredients or components, and/or processing; or

C. For a claim that a product is assembled in the United States, the product is last substantially transformed in the United States, the product’s principal assembly takes place in the United States, and United States assembly operations are substantial.

Fast forward several years and Williams-Sonoma advertised its PBTeen mattress pads as “Crafted in America from domestic and imported materials.” But the FTC says some of those mattress pads were wholly imported from China. In the course of looking at other Williams-Sonoma representations, FTC staff identified six additional products advertised with questionable Made in USA claims. According to the complaint, for each of those products, the company couldn’t demonstrate that final assembly or processing occurred in the United States, all significant processing occurred in the U.S., and all or virtually all ingredients or components were made and sourced here. Therefore, the FTC alleges that Williams-Sonoma violated the 2020 order both with regard to the Chinese-made mattress pads and the other six products.

The settlement in the just-announced action includes a $3.17 million civil penalty – the largest ever in an FTC Made in USA case. Also, in a first for a Made in USA action, the order requires Williams-Sonoma to submit certifications confirming it has implemented controls sufficient to ensure compliance with the order and isn’t aware of any material noncompliance not already corrected or disclosed to the FTC.

In addition to our two lead-off compliance pointers, the new Williams-Sonoma settlement offers more insights for companies that make Made in USA claims.

False or deceptive Made in USA claims injure both the buying public and businesses that comply with the law. There are two good reasons why Made in USA enforcement is an important FTC priority. For many consumers, a Made in USA claim can be the deciding factor in choosing among competing products. So when a company says “Made in USA” or uses similar phrases, it must deliver on that promise. Furthermore, when the FTC takes enforcement action, consumers aren’t the only injured parties. Also harmed are businesses that take care to substantiate their U.S.-origin promises or refrain from making those claims without proper proof. Those companies shouldn’t have to go head-to-head against competitors that pass off foreign-made goods as Made in USA.

How seriously does the FTC take order enforcement? Very seriously. When companies are under FTC order, they typically must file periodic reports describing “in detail whether and how [the company] is in compliance with each provision of the order, including a discussion of all of the changes . . . made to comply with the Order.” According to the complaint, Williams-Sonoma’s compliance report signed by a corporate official explained how the company supposedly complied with every provision of the FTC Order. Despite those assurances, the FTC says the company violated the order by making false, deceptive, or unsubstantiated representations. Repeat violations are looked upon with disfavor and this proved to be a costly error for Williams-Sonoma.

Have your substantiation ducks in a row before promoting products as Made in USA. It’s Consumer Protection Law 101 that companies must have proof in hand to support all objective claims before they disseminate those representations to consumers. That goes for U.S.-origin claims, too. The Williams-Sonoma settlement requires the company to implement a certification system, the violation of which could result in additional civil penalties. But why wait until the FTC or another law enforcer sends a subpoena before setting up an in-house compliance check? It doesn’t have to be fancy. Pertinent documents in a file folder or on your network are all you may need to back up your claims.

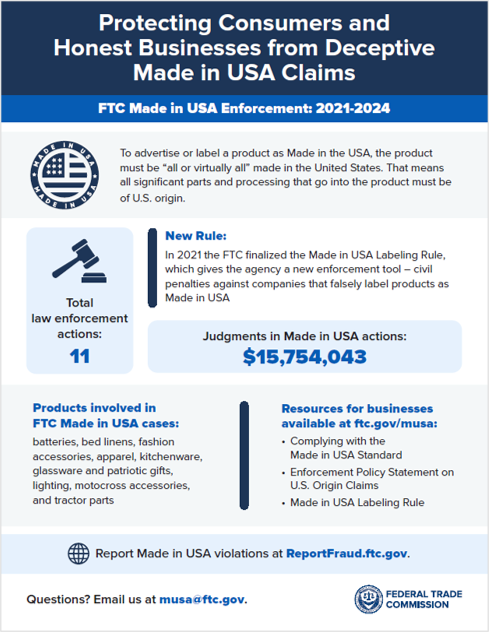

Read Complying with the Made in USA Standard for more information and consider whether your claims are also covered by the Made in USA Labeling Rule. Check out this summary of recent Made in USA developments at the FTC.

It is your choice whether to submit a comment. If you do, you must create a user name, or we will not post your comment. The Federal Trade Commission Act authorizes this information collection for purposes of managing online comments. Comments and user names are part of the Federal Trade Commission’s (FTC) public records system, and user names also are part of the FTC’s computer user records system. We may routinely use these records as described in the FTC’s Privacy Act system notices. For more information on how the FTC handles information that we collect, please read our privacy policy.

The purpose of this blog and its comments section is to inform readers about Federal Trade Commission activity, and share information to help them avoid, report, and recover from fraud, scams, and bad business practices. Your thoughts, ideas, and concerns are welcome, and we encourage comments. But keep in mind, this is a moderated blog. We review all comments before they are posted, and we won’t post comments that don’t comply with our commenting policy. We expect commenters to treat each other and the blog writers with respect.

- We won’t post off-topic comments, repeated identical comments, or comments that include sales pitches or promotions.

- We won’t post comments that include vulgar messages, personal attacks by name, or offensive terms that target specific people or groups.

- We won’t post threats, defamatory statements, or suggestions or encouragement of illegal activity.

- We won’t post comments that include personal information, like Social Security numbers, account numbers, home addresses, and email addresses. To file a detailed report about a scam, go to ReportFraud.ftc.gov.

We don't edit comments to remove objectionable content, so please ensure that your comment contains none of the above. The comments posted on this blog become part of the public domain. To protect your privacy and the privacy of other people, please do not include personal information. Opinions in comments that appear in this blog belong to the individuals who expressed them. They do not belong to or represent views of the Federal Trade Commission.

I wholeheartedly agree and support the FTC in their quest for honest business practices. Many times, a marking saying Made in America will be the deciding factor whether I buy the product or not. It is very important for me to trust that.

Add new comment