Gimme an F!

Gimme an A!

Gimme an L!

Gimme an S!

Gimme an E!

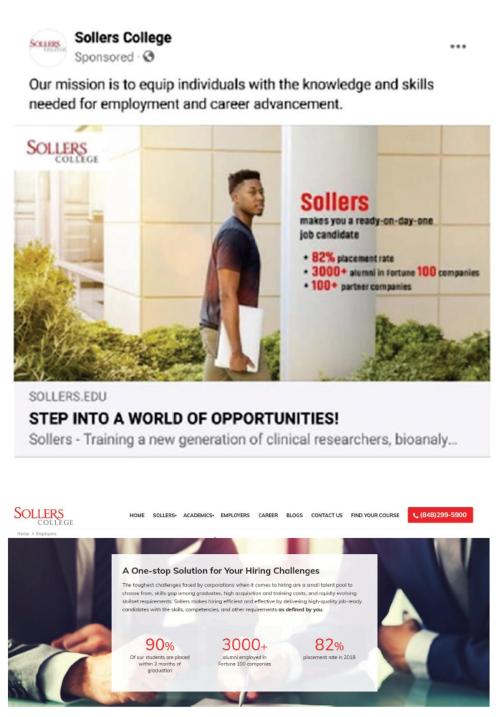

What’s that spell? “False,” of course, which – along with deceptive and unsubstantiated – is how the FTC describes claims made by Sollers Education, also doing business as Sollers College. The complaint alleges the defendants lured prospective students in with inflated job placement rates and misleading representations about employment partnerships with big-name businesses. What’s more, the defendants encouraged some students pay their tuition by giving Sollers a cut of their future salary – “income share agreements” the FTC says violated the Holder Rule. Under the terms of the proposed settlement, the defendants will cancel $3.4 million in student debt and change their marketing practices going forward.

Sollers College is a for-profit school that offers courses online and at a New Jersey campus. Charging tuition ranging from $4,000 to $27,000 for short-term programs that last a few weeks or a few months, Sollers advertises certifications in fields like IT and life sciences. A centerpiece of Sollers’ marketing efforts are claims on its website and in promotions on YouTube, Instagram, and other social media emphasizing graduates’ supposed success in finding employment quickly. For example, one ad touted that “90% of our students are placed within 3 months of graduation.” Elsewhere, Sollers said, “We record an 82% placement rate within three months of graduation.” Sollers also sent emails to prospective students, claiming to have a “near perfect” success rate in placing graduates in jobs.

And it wasn’t just any old job. Sollers claimed that its partnerships with leading companies like Pfizer, Weill Cornell Medicine, and Infosys resulted in jobs for Sollers’ graduates with those businesses. The “Testimonials” and “Success Stories” pages on Sollers’ site featured the logos of more than 20 companies that Sollers described as “Our Employer Partners.”

That’s what Sollers told prospective students, but the FTC says the defendants’ actual “report card” tells a different story. According to the complaint, the defendants had “no reasonable basis for their 80%, 82%, 90%, or ‘near perfect’ job placement claims, much less that they are able to do so within 3 months of graduation.” So where do those figures come from? The FTC alleges that “Defendants inflate the number of students they claim to ‘place’ by including anyone who does not communicate with Sollers after graduating.” In fact, Sollers’ own data suggest that the current job placement rate for its Life Sciences graduates is as low as 52%.

What about those “partnerships” with the “industry-leading corporations” whose names or logos appeared on Sollers’ site? According to the FTC, many of those businesses “have no partnership with the school whatsoever, much less one that results in Sollers graduates getting jobs at those companies.” For example, in May 2022, Weill Cornell Medicine sent Sollers a cease-and-desist letter demanding the removal of its name and logo from the site because the claim it was an “employer partner” or “corporate partner” was “false and misleading.” Staffing company Aerotek sent a similar letter demanding that Sollers remove its name and logo.

But those aren’t the only illegalities Sollers allegedly inflicted on students. Sollers encouraged some students to enter into “income share agreements” (ISAs) that require students to cover the cost of tuition by paying the school a share of their future income – generally 10%-20% for two years. You’ll want to read the complaint for details, but the gist of the agreements is that the cost of tuition was converted into a debt obligation that students had to repay. Depending on the terms of their specific ISA and possible loan payment deferments, some Sollers graduates found themselves paying for as long as six years. Sollers made the failure to pay particularly costly for students, reserving the right to collect a lump-sum payment – generally around $45,000 plus fees and collection costs.

The complaint alleges that “approximately 90% of students who entered into ISAs with Sollers are either actively in repayment or defaulted on their agreements and now owe Sollers a fixed amount.” The FTC says Sollers has responded by turning over accounts of many defaulting graduates to third-party debt collectors.

A closer look at many of Sollers’ ISAs reveal that they failed to include mandatory notices required by the FTC’s Holder Rule to protect consumers. Under the Rule, consumer credit contracts must include this notice informing consumers of their right to assert claims and defenses about the seller’s misconduct – for example, that the seller made deceptive representations – against any holder of the contract:

NOTICE

ANY HOLDER OF THIS CONSUMER CREDIT CONTRACT IS SUBJECT TO ALL CLAIMS AND DEFENSES WHICH THE DEBTOR COULD ASSERT AGAINST THE SELLER OF GOODS OR SERVICES OBTAINED PURSUANT HERETO OR WITH THE PROCEEDS HEREOF. RECOVERY HEREUNDER BY THE DEBTOR SHALL NOT EXCEED AMOUNTS PAID BY THE DEBTOR HEREUNDER.

By omitting that key consumer protection requirement, the defendants violated the Holder Rule, alleges the FTC.

In addition to prohibiting misrepresentations about any educational product or service, the proposed settlement will cancel all of Sollers’ income share agreements. Under the order, Sollers also must stop collecting debts from students on ISAs it currently holds, buy back ISAs it sold to third parties, ask credit bureaus to delete the debt from consumers’ credit reports, and directly notify the consumers who will receive the $3.4 million in debt forgiveness. Sollers also can’t deny consumers access to diplomas or transcripts based on any debt forgiven by the proposed order.

If you’re familiar with cases the FTC has brought against other for-profit educational companies, the proposed order provisions about deceptive job placement rates and employer partnerships should look familiar. But the case also offers a key compliance message with implications far beyond that sector: If your company is considering a “new” type of financing product, carefully consider your obligations under long-standing consumer protection laws and rules.

It is your choice whether to submit a comment. If you do, you must create a user name, or we will not post your comment. The Federal Trade Commission Act authorizes this information collection for purposes of managing online comments. Comments and user names are part of the Federal Trade Commission’s (FTC) public records system, and user names also are part of the FTC’s computer user records system. We may routinely use these records as described in the FTC’s Privacy Act system notices. For more information on how the FTC handles information that we collect, please read our privacy policy.

The purpose of this blog and its comments section is to inform readers about Federal Trade Commission activity, and share information to help them avoid, report, and recover from fraud, scams, and bad business practices. Your thoughts, ideas, and concerns are welcome, and we encourage comments. But keep in mind, this is a moderated blog. We review all comments before they are posted, and we won’t post comments that don’t comply with our commenting policy. We expect commenters to treat each other and the blog writers with respect.

We don't edit comments to remove objectionable content, so please ensure that your comment contains none of the above. The comments posted on this blog become part of the public domain. To protect your privacy and the privacy of other people, please do not include personal information. Opinions in comments that appear in this blog belong to the individuals who expressed them. They do not belong to or represent views of the Federal Trade Commission.