Every year, millions of consumers tell us – and our partners – about the frauds they spotted. In 2018, we heard from 3 million people and learned a lot from the reports entered into our Consumer Sentinel database. Here are some notable facts from the Consumer Sentinel Network’s 2018 Data Book – including that a new category of scams has earned the unenviable right to chant "We’re #1."

We collected more than 1.4 million fraud reports, and people said they lost money to the fraud in 25% of those reports. People reported losing $1.48 billion (with a “b” ) to fraud last year – an increase of 38% over 2017.

We collected more than 1.4 million fraud reports, and people said they lost money to the fraud in 25% of those reports. People reported losing $1.48 billion (with a “b” ) to fraud last year – an increase of 38% over 2017.- The top reports in 2018 were: imposter scams, debt collection, and identity theft.

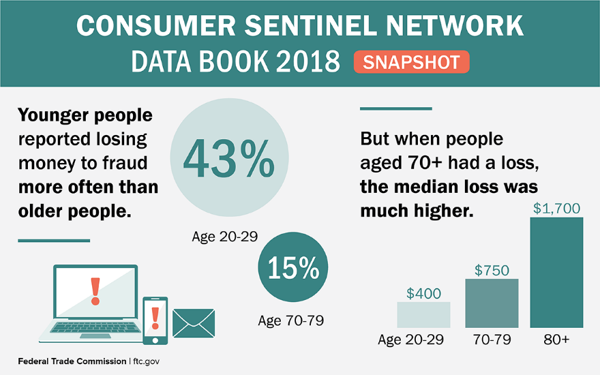

- Younger people reported losing money to fraud more often than older people. Let that sink in. It’s what the data have been telling us for a while, but it’s hard for people to grasp. Last year, of those people who reported fraud and their age, 43% of people in their 20s reported a loss to that fraud, while only 15% of people in their 70s did.

- When people in their 70s did lose money, the amount tended to be higher: their median loss was $751, compared to $400 for people in their 20s.

- Scammers like to get money by wire transfer – for a total of $423 million last year. That was the most of any payment method reported, but we also saw a surge of payments with gift and reload cards – a 95% increase in dollars paid to scammers last year.

- Tax-related identity theft was down last year (by 38%), but credit card fraud on new accounts was up 24%. In fact, misusing someone’s information to open a new credit card account was reported more often than other forms of identity theft in 2018.

- The top 3 states for fraud and other reports (per 100K population) are Florida, Georgia and Nevada. The top 3 states for identity theft reports (also per 100K) are Georgia, Nevada and California.

The Consumer Sentinel Network’s online database is available to more than 2,500 users in civil and criminal law enforcement agencies across the country and around the world. Agencies use the reports to research cases, identify victims, and track possible targets. Although non-governmental organizations may contribute data, only law enforcers can access the database.

Check out what happened in your state. In fact, you can slice and dice the numbers yourself. And comment below if you find something interesting. Meanwhile, consumers should keep reporting to the FTC at ftc.gov/complaint. We use those reports to investigate and bring cases – and so do our thousands of law enforcement partners.

In reply to There are scammers who pose by Guest

Please report that to the FTC at www.FTC.gov/Complaint, or call 1-877-382-4357.