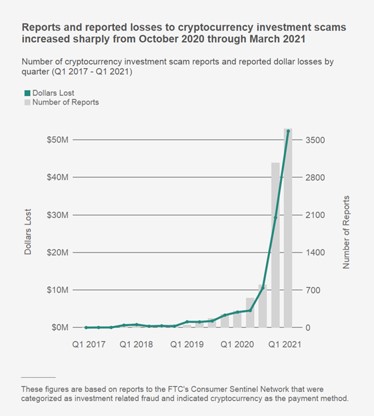

Thinking about adding cryptocurrency to your investment portfolio? The number of Americans investing in cryptocurrency has increased. But as a new FTC Consumer Protection Data Spotlight suggests, the number who report getting stung by cryptocurrency investment scams has skyrocketed. You’ll want to read the Data Spotlight in detail, but here are five facts that suggests caution before sinking your savings into cryptocurrency.

Consumers report losing millions to cryptocurrency scams. Since October 2020, nearly 7,000 consumers have reported losses to cryptocurrency scams totaling more than $80 million with a reported median loss of $1,900. Compared to the same period a year earlier, that’s about 12 times the number of reports and nearly 1,000% more in reported losses.

Consumers report losing millions to cryptocurrency scams. Since October 2020, nearly 7,000 consumers have reported losses to cryptocurrency scams totaling more than $80 million with a reported median loss of $1,900. Compared to the same period a year earlier, that’s about 12 times the number of reports and nearly 1,000% more in reported losses.- Cryptocurrency scammers blend into the scene. Cryptocurrency enthusiasts tend to congregate online to talk about their shared interest. But reports from defrauded consumers suggest that some sites can raise concerns. Is the author of that post just a friendly person sharing an investment “tip” or is he or she part of a ploy to draw consumers into a scam? Prospective investors also need to take supposed “success stories” from endorsers with a hearty helping of salt. There’s no way to verify they’re telling the truth.

- A celebrity’s name is no guarantee of legitimacy. Crypto crooks may try to cover their con by stealing the name of a newsmaker or business leader – for example, by falsely claiming the celebrity will “multiply” the cryptocurrency a consumer sends. Case in point: In just the past six months, people have reportedly sent more than $2 million in cryptocurrency to Elon Musk impersonators.

- (Cyber) romance and (crypto) finance can be a combustible combination. Fraudsters have been known to use the artifice of long-distance love to gain a person’s trust only to reel them into a cryptocurrency investment scam. According to the Data Spotlight, about 20% of the money people reported losing through romance scams since October 2020 was sent in the form of cryptocurrency – and many of them thought they were making an investment recommended by their supposed sweetheart.

- Younger investors may be at particular risk. Since October 2020, people between 20 and 49 were over five times more likely to report losing money to cryptocurrency investment scams than older consumers. What’s more, those in their 20s and 30s reported losing far more money on investment scams than on any other type of fraud – and more than half of their reported investment scam losses were in cryptocurrency. But that doesn’t mean that consumers over 50 weren’t affected, too. Members of that age group were far less likely to report losing money on cryptocurrency investment scams. However, when they did lose money, their individual losses were higher, with a reported median loss of $3,250.

Even sophisticated business people have been taken in by cryptocurrency investment scams and the Data Spotlight has specific tips on protecting yourself. For more information about cryptocurrency scams, visit ftc.gov/cryptocurrency. If you spot a scam, report it to us at ReportFraud.ftc.gov.