“BEST DAMN AMERICAN MADE GEAR ON THE PLANET” So roared a Utah-based company called Lions Not Sheep in promoting its apparel and accessories online. But according to an FTC complaint, the company was pulling the wool over consumers’ eyes. Lions Not Sheep just signed a proposed settlement with the FTC over the company’s allegedly false Made in USA claims.

Lions Not Sheep sells merchandise through social media, on Amazon, and on Etsy. It has described itself as a lifestyle brand that allow customers to “show people it’s possible to live your life as a LION, Not a sheep.” The company and its owner Sean Whalen pitched their politically-themed hats, tees, sweatshirts, etc., with claims that their merchandise was “Made in the USA,” “Made in America,” and “100% AMERICAN MADE.”

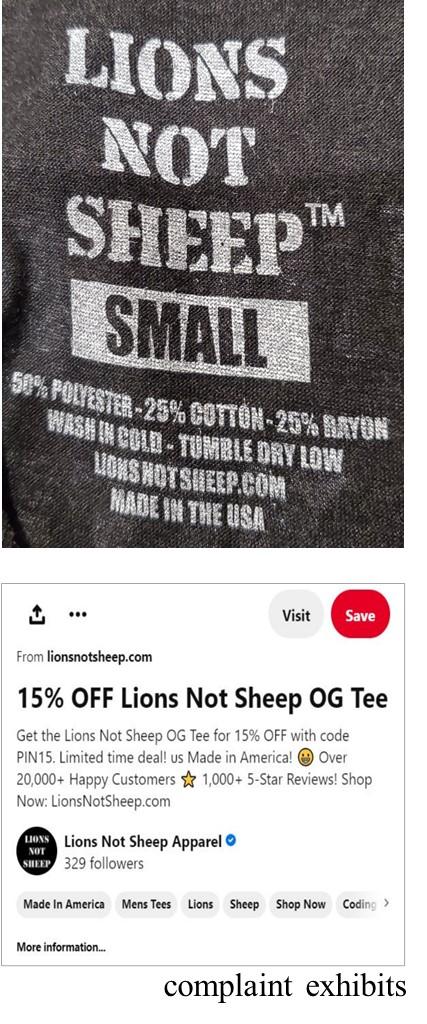

But compare that with a video Whalen posted on his social media accounts. Featuring a Chinese flag and the title “MADE IN AMERICA!,” the video showed Whalen claiming he could hide the fact that his shirts are made in China by ripping out the origin tags and replacing them with Made in USA tags. And according to the FTC, that’s just what Whalen and his company did. The complaint alleges that between May and October 2021, Whalen and Lions Not Sheep removed tags disclosing that items were made in a foreign country and went so far as to print “Made in the USA” at the neck of shirts that were manufactured elsewhere. The FTC says that in most cases, the products advertised with Made in USA promises were wholly imported with limited finishing work performed in the United States.

The complaint alleges that Whalen and Lions Not Sheep violated the FTC Act by falsely advertising products as Made in USA. In addition, the complaint charges them with violating mandatory country-of-origin labeling rules that apply to products covered by the Textile Act.

The proposed settlement includes a $211,335 financial remedy and prohibits any misleading or unsubstantiated claim for any product or service. In addition, Whalen and Lions Not Sheep are prohibited from making Made in USA claims unless the final assembly or processing of the product occurs in the USA, all significant processing occurs here, and all or virtually all ingredients or components are made and sourced here. “Assembled in the USA” claims require that the product’s principal assembly takes place in the USA and that the U.S. assembly operations are substantial. Once the proposed settlement is published in the Federal Register, the FTC will receive public comments for 30 days.

The case suggests some compliance takeaways for other businesses.

Keep your Made in USA claims Yankee Doodle Dandy. “Made in USA” isn’t just flag-waving puffery. It’s an objective claim that companies must substantiate with solid proof. Misleading Made in USA claims inflict an injurious double-whammy. They harm consumers who rely on those representations in making purchase decisions. And they illegally take business away from competitors who work hard to comply with the “all or virtually all” standard.

Clothe your clothing claims in credibility. In addition to the FTC Act’s general prohibition of deceptive claims, apparel covered by the Textile Rules is subject to mandatory country-of-origin labeling. Unfamiliar with that requirement? Consult the Textile Fiber Products Identification Act Rules and read the FTC’s guide for business, Threading Your Way Through the Labeling Requirements Under the Textile and Wool Acts.

Deceptive Made in USA claims can cost you. If you’re covered by the FTC’s new Made in USA Labeling Rule, misleading representations can result in substantial civil penalties. The Rule also reinforces the long-standing principle that it’s a violation of the FTC Act to “label any product as Made in the United States unless the final assembly or processing of the product occurs in the United States, all significant processing that goes into the product occurs in the United States, and all or virtually all ingredients or components of the product are made and sourced in the United States.”

It is your choice whether to submit a comment. If you do, you must create a user name, or we will not post your comment. The Federal Trade Commission Act authorizes this information collection for purposes of managing online comments. Comments and user names are part of the Federal Trade Commission’s (FTC) public records system, and user names also are part of the FTC’s computer user records system. We may routinely use these records as described in the FTC’s Privacy Act system notices. For more information on how the FTC handles information that we collect, please read our privacy policy.

The purpose of this blog and its comments section is to inform readers about Federal Trade Commission activity, and share information to help them avoid, report, and recover from fraud, scams, and bad business practices. Your thoughts, ideas, and concerns are welcome, and we encourage comments. But keep in mind, this is a moderated blog. We review all comments before they are posted, and we won’t post comments that don’t comply with our commenting policy. We expect commenters to treat each other and the blog writers with respect.

We don't edit comments to remove objectionable content, so please ensure that your comment contains none of the above. The comments posted on this blog become part of the public domain. To protect your privacy and the privacy of other people, please do not include personal information. Opinions in comments that appear in this blog belong to the individuals who expressed them. They do not belong to or represent views of the Federal Trade Commission.

Are the statutory penalties adequate to deter effectively the persons who cause the deceptive statements to be made? Should the penalties be substantially increased with a provision that they might be subject to reduction if established to the satisfaction of the Commission that the deceptive statement was made inadvertently? Or without intending to deceive?

Chalk one up for the FTC. The "Made in America" label is the most important label proving that the manufacturing was DONE in the US. What "Lions not sheep" was doing is absolutely the worst approach to NOT validating the principles and manufacturing process that this nation was built on. The business model of deception has got to be recognized for the undermining and destroying process that it really is in real life. Now, please, for all the present US citizens, and especially future US citizens of the next generations, start doing the same with the IT businesses that are the worst examples of opportunists capitalizing from deceptive business practices from the point "0".

In reply to Chalk one up for the FTC. … by Elizabeth Pula

Maybe ACTUALLY look into Lions not Sheep and realize what they stand for and what they do.

In reply to Maybe ACTUALLY look into… by Tyler M

It’s worse than I thought lol.

In reply to Chalk one up for the FTC. … by Elizabeth Pula

HAHAHAHAHAHAHA. You have no idea of what really happened here. It is a liberal biased Fed wing going after a conservative.

In reply to Chalk one up for the FTC. … by Elizabeth Pula

So, were the tags at least Made In The U.S.A.?

So let me get this straight. LIONS NOT SHEEP, doesn’t remove tags, leaves tags telling you where the clothing is made, produces the art work, employees Americans, prints the artwork, bags the clothing, ships from America - but because you don’t like Sean or LNS, they’re laying false claims? Way to attack someone for following your rules, and then changing the rules to suit your agenda. FTC is a joke.

According to the company, they were in compliance until the rules were changed in 2021, which they corrected upon learning this. That’s why this only covers a few months. You should have included that for transparency, rather than “lambasting” the company as if they were intentionally doing something wrong.

That being said, we do appreciate what you do to protect America’ interests.

Get your facts correctly!

Why didn't you refer this to the DOJ to investigate mail fraud? Every time they sent an item through the USPS with a changed tag it was a separate act of mail fraud. I hope you didn't give them immunity from criminal charges as part of your settlement.