Pretending to be someone people trust is what scammers do. They may claim to be a well-known company or a beloved family member, but data from the FTC’s Consumer Sentinel Network suggest that pretending to be the government may be scammers’ favorite ruse. Since 2014, the FTC has gotten nearly 1.3 million reports about government imposters. That’s far more than any other type of fraud reported in the same timeframe. This spring, monthly reports of government imposter scams reached the highest levels we have on record.1

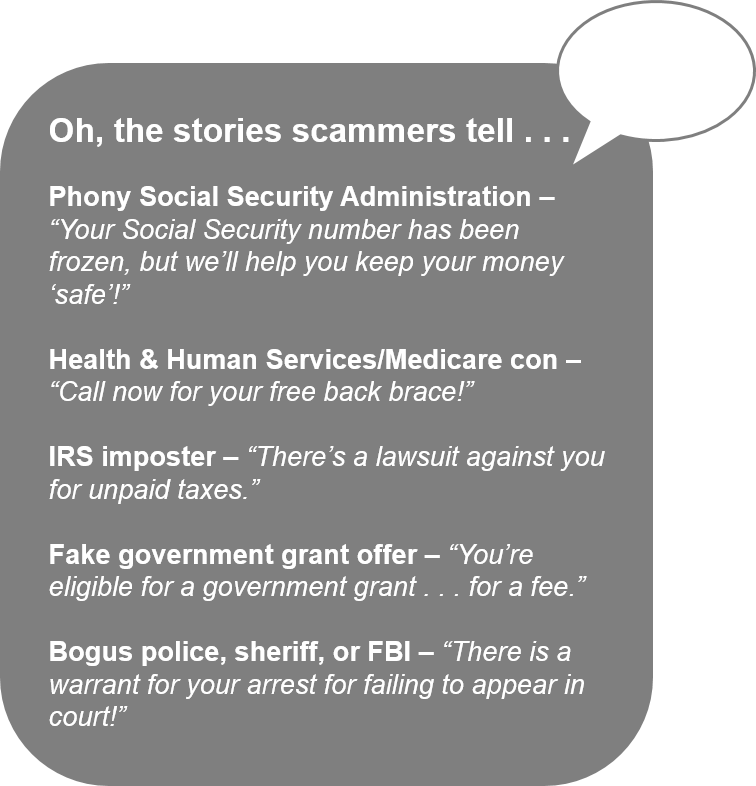

The vast majority of people who report this type of scam say it started with a phone call,2 and these callers have their mind games down pat. Government impersonators can create a sense of urgent fear, telling you to send money right away or provide your social security number to avoid arrest or some other trouble. Or they can play the good guy, promising to help you get some free benefit like a grant or prize, or even a back brace. Scammers like to make the situation so immediate that you can’t stop to check it out.

The vast majority of people who report this type of scam say it started with a phone call,2 and these callers have their mind games down pat. Government impersonators can create a sense of urgent fear, telling you to send money right away or provide your social security number to avoid arrest or some other trouble. Or they can play the good guy, promising to help you get some free benefit like a grant or prize, or even a back brace. Scammers like to make the situation so immediate that you can’t stop to check it out.

These scams can be extremely lucrative. Reported losses to government imposter scams add up to more than $450 million since 2014. Only 6% of people who report government imposters say they lost money.3 But when people do lose money, it’s a lot: the median individual reported loss is $960.4 People ages 20 to 59 report losing money to these scams at higher rates than people 60 and over, but median individual reported losses increase with age. People 80 and over report a median loss of $2,700.5

Gift cards are now the payment method of choice for these scammers. Most people who tell us they lost money to a government imposter say they gave the scammer the PIN number on the back of gift cards like Google Play or iTunes cards.6 Wire transfers come in a distant second to gift cards as a payment method. But with both methods, the scammer gets quick cash while staying anonymous, and the money is simply gone.

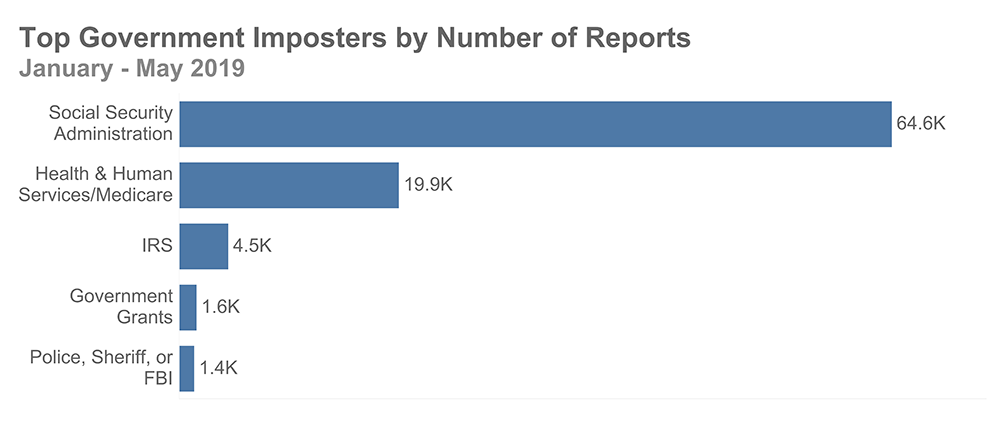

The top government imposters reported so far in 2019 have both familiar and new faces. The FTC reported recently about the dramatic surge in Social Security imposters, but IRS imposters are still hanging on in the top five. Scammers use “bureau” or “administration” in their name to make their government grant offers sound official, and use generic names like “sheriff’s office” to suggest a hefty law enforcement presence. Government imposters will adapt quickly to find new ways to get your money. Lots of government agencies have been impersonated, including the FTC. The scammer’s pitch is even more convincing when they fake the number on your caller ID so it shows the name or phone number of a real government agency. It’s illegal to fake the number on caller ID, but scammers know it helps convince people that the caller really is with the government.

So what can you do to protect yourself against imposters when their stories keep changing?

- Be suspicious of any call from a government agency asking for money or information. Government agencies don’t call you with threats, or promises of – or demands for – money. Scammers do.

- Don’t trust caller ID – it can be faked. Even if it might look like a real call, don’t trust it.

- Never pay with a gift card or wire transfer. If someone tells you to pay this way, it’s a scam.

- Check with the real agency. Look up their number. Call them to find out if they’re trying to reach you – and why.

Report government imposter scams to the FTC at FTC.gov/complaint. To learn more, visit ftc.gov/imposters. Want to explore the data? Visit the new interactive infographic on government imposters.

1 People reported about 41,400, 39,600, and 46,600 government imposter scams to Sentinel in March, April, and May 2019 respectively. Prior to March 2019, the highest monthly reporting levels for government imposter scams on record were in September 2016 with about 38,400 reports filed.

2 From January 2018 through May 2019, 96% of people who reported a government imposter scam and specified a contact method said they were contacted by telephone.

3 Figure based on reports to Sentinel from January 2018 through May 2019 that were classified as government imposter scams.

4 Median loss calculations are based on government imposter reports submitted to Sentinel from January 2018 through May 2019 that indicated a monetary loss ($1 - $999,999).

5 Age comparison and median loss figure based on government imposter reports in from January 2014 through May 2019 that indicated a monetary loss. People who said they were 20 – 59 filed loss reports at a rate of 269 reports per million people in this age group, while people who said they were 60 and over filed 211 loss reports per million people in this age group. Population numbers obtained from the U.S. Census Bureau: U.S. Census Bureau, Annual Estimates of the Resident Population for Selected Age Groups by Sex for the United States, States, Counties and Puerto Rico Commonwealth and Municipios (June 2018). Not all reports include usable age information.

6 Gift\reload cards were identified as the payment method for 58% of government imposter reports to Sentinel from January 2018 through May 2019 that indicated a payment method. Wire transfers were identified as the payment method for 13% of these reports.