A Pennsylvania-based home builder that offers home financing has settled Federal Trade Commission charges that it deceived consumers by advertising low-cost mortgages while hiding fees and not disclosing vital information about the true cost of the mortgages. “These defendants tricked consumers into believing they’d found an affordable mortgage with very favorable terms,” said Jessica Rich, Director of the FTC’s Bureau of Consumer Protection. “The FTC is committed to holding mortgage advertisers accountable.”

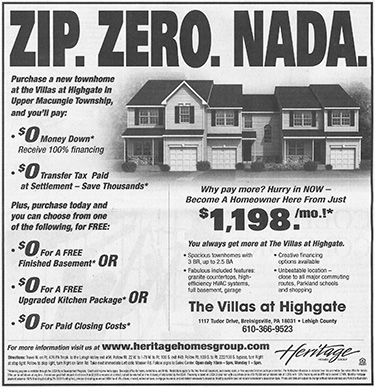

Heritage Homes newspaper advertisement (click to enlarge)

Using the catch phrase "Zip, Zero, Nada," Heritage Homes Group claimed in ads on websites, and in newspapers, flyers, and direct mail, that consumers could finance their homes without a down payment or closing costs. In fact, they were required to pay a “good faith deposit,” settlement costs, and an annual fee, according to the complaint.

The defendants’ ads also touted specific monthly payment amounts, such as $1,198 per month, but they failed to disclose that to get such a low monthly payment, consumers would have to obtain financing through the USDA Rural Development Loan Program, which requires them to meet specific credit and income criteria. The defendants also failed to make adequate disclosures about the annual percentage rates consumers would pay for the mortgages.

The complaint alleges that the operation violated the Federal Trade Commission Act; the Mortgage Acts and Practices Advertising Rule (or “MAP” Rule) and Regulation N; and the Truth in Lending Act and Regulation Z.

Under the settlement, Heritage Homes Group, Inc. and four affiliated companies are prohibited from:

- misrepresenting the terms of any mortgage credit product including the interest charged, the annual percentage rate, the existence or amount of fees or costs to the consumer, the consumer’s monthly payment, and taxes and insurance, among other things.

- misrepresenting or assisting others to misrepresent any relevant facts concerning the sale of homes and related products and services, such as the total costs; any material restrictions, limitations, or conditions, including that the consumers will pay $0 money down to purchase a home or for a mortgage; and that consumers will receive 100% financing and pay no closing costs to buy a home or get a mortgage loan.

- representing a periodic payment amount, and failing to adequately disclose when applicable:

- that the loan requires qualifying and financing through the USDA Rural Development Loan Program or another financing program that imposes credit and income limits.

- that the loan requires a good faith deposit and a guaranty fee, and

- the amount or percentage of those fees, among other things, in violation of Regulation N, the Truth in Lending Act, and Regulation Z.

- failing to keep a record of advertising to demonstrate that they are complying with the order.

The FTC established the MAP Rule, which later became Regulation N, to strengthen consumer protections by banning deceptive claims about mortgages. The rule allows the FTC to seek civil penalties for violations. The settlement with defendants imposes a $650,000 civil penalty, which is suspended because of the operation’s poor financial condition. If it is later determined that the financial information the defendants provided the FTC was false, the full amount of the judgment will become due.

For consumer information about mortgages, see Homes and Mortgages.

In addition to Heritage Homes Group, Inc., the complaint names Heritage Building Group, Inc.; Heritage Highgate, Inc.; Heritage Partners, Inc.; and CJL Realty management, LLC.

The Commission vote to authorize the staff to refer the complaint to the Department of Justice, and to approve the proposed consent decree, taken before Commissioner Terrell McSweeny joined the agency, was 4-0.

The DOJ filed the complaint and proposed consent decree on behalf of the Commission in U.S. District Court for the Eastern District of Pennsylvania, and the consent decree was entered on June 6, 2014

NOTE: The Commission authorizes the filing of a complaint when it has “reason to believe” that the law has been or is being violated, and it appears to the Commission that a proceeding is in the public interest. Consent decrees have the force of law when signed by the District Court judge.

The Federal Trade Commission works for consumers to prevent fraudulent, deceptive, and unfair business practices and to provide information to help spot, stop, and avoid them. To file a complaint in English or Spanish, visit the FTC’s online Complaint Assistant or call 1-877-FTC-HELP (1-877-382-4357). The FTC enters complaints into Consumer Sentinel, a secure, online database available to more than 2,000 civil and criminal law enforcement agencies in the U.S. and abroad. The FTC’s website provides free information on a variety of consumer topics. Like the FTC on Facebook, follow us on Twitter, and subscribe to press releases for the latest FTC news and resources.

Contact Information

MEDIA CONTACT:

Betsy Lordan

Office of Public Affairs

202-326-2180

STAFF CONTACT:

Carole Reynolds

Bureau of Consumer Protection

202-326-3230