The primary purpose of the FTC’s CARS Rule is to add truth and transparency to the car buying and leasing process by making it clear that certain deceptive or unfair practices are illegal – for example, bait-and-switch tactics, hidden charges, and other conduct that harms consumers and honest dealers. Why is it called the CARS Rule? Because the Rule is about Combating Auto Retail Scams that cost consumers billions of dollars each year and cause honest dealers to lose business.

The Rule lays out four basic principles to protect people shopping for cars and trucks – practices that are already business-as-usual for honest dealers. This Dealers Guide introduces industry members to what the CARS Rule means for their dealerships.

- An introduction to the FTC’s CARS Rule

- The CARS Rule prohibits misrepresentations about material information.

- The CARS Rule requires dealers to clearly disclose the offering price – the actual price anyone can pay to get the car.

- The CARS Rule makes it illegal to charge consumers for add-ons that don’t provide a benefit.

- The CARS Rule requires dealers to get consumers’ express, informed consent before charging them for anything.

- Answers to questions dealers may have about the CARS Rule

- Glossary

An introduction to the FTC CARS Rule

Buying or leasing a car is a major financial commitment and it’s a transaction that consumers have often approached with apprehension or uncertainty. Indeed, according to the public comments the FTC received as part of rulemaking process for the CARS Rule, many consumers believe they have been subjected to deceptive or unfair practices when buying or leasing a car – especially bait-and-switch tactics and hidden charges. Particularly troubling were reports from servicemembers about deceptive and predatory practices near military installations, and from car dealers about losing business to dishonest dealerships. Those comments underscore what the FTC has observed in decades of law enforcement actions: that unscrupulous dealerships have used illegal tactics to close a deal – conduct that costs consumers time and money and puts honest dealers at an unfair disadvantage.

The Federal Trade Commission’s Combating Auto Retail Scams Trade Regulation Rule – the CARS Rule, for short – ushers in a new era of transparency in car buying and leasing. Most importantly, the Rule explains how long-standing principles of truth in advertising and fair dealing apply when people go car shopping.

The CARS Rule is a big win for consumers, who can expect that established standards of truth and transparency that apply in other consumer transactions will also apply when they’re looking to buy or lease a car. What’s more, now they can point to specific legal provisions that will help protect them in the process. If consumers see that a dealer is complying with the CARS Rule, it adds a measure of confidence. But if they spot a dealer who flouts those protections, consumers may take their business elsewhere.

The CARS Rule also is a big win for honest industry members who already implement the Rule’s principles of truth and transparency at their dealerships. Most salespeople can recount a story of losing a sale to a cross-town competitor who used questionable tactics to lure away a prospective customer. That shouldn’t happen. Dealers who work hard to treat customers fairly shouldn’t have to go head-to-head against competitors who resort to deception to close a deal. The CARS Rule establishes clear rules of the road that apply to all car dealers – meaning that consumers will be able to comparison shop based on truthful claims about price, financing, and service. When all dealers are held to the same clear standards, dealers who meet (or exceed) consumers’ expectations have a fair shot at winning the sale, gaining customers’ loyalty, and earning a word-of-mouth reputation as the dealer to do business with. Another benefit is that the CARS Rule accomplishes these goals without requiring consumers or dealers to fill out more paperwork.

As explained in more detail in this Dealers Guide – and as decades of work by the FTC and other law enforcement partners makes clear – the four principles of truth and transparency outlined in the CARS Rule aren’t new. The Rule simply restates those principles in straightforward language specific to the auto industry and includes new remedies if a car dealer engages in certain deceptive or unfair practices.

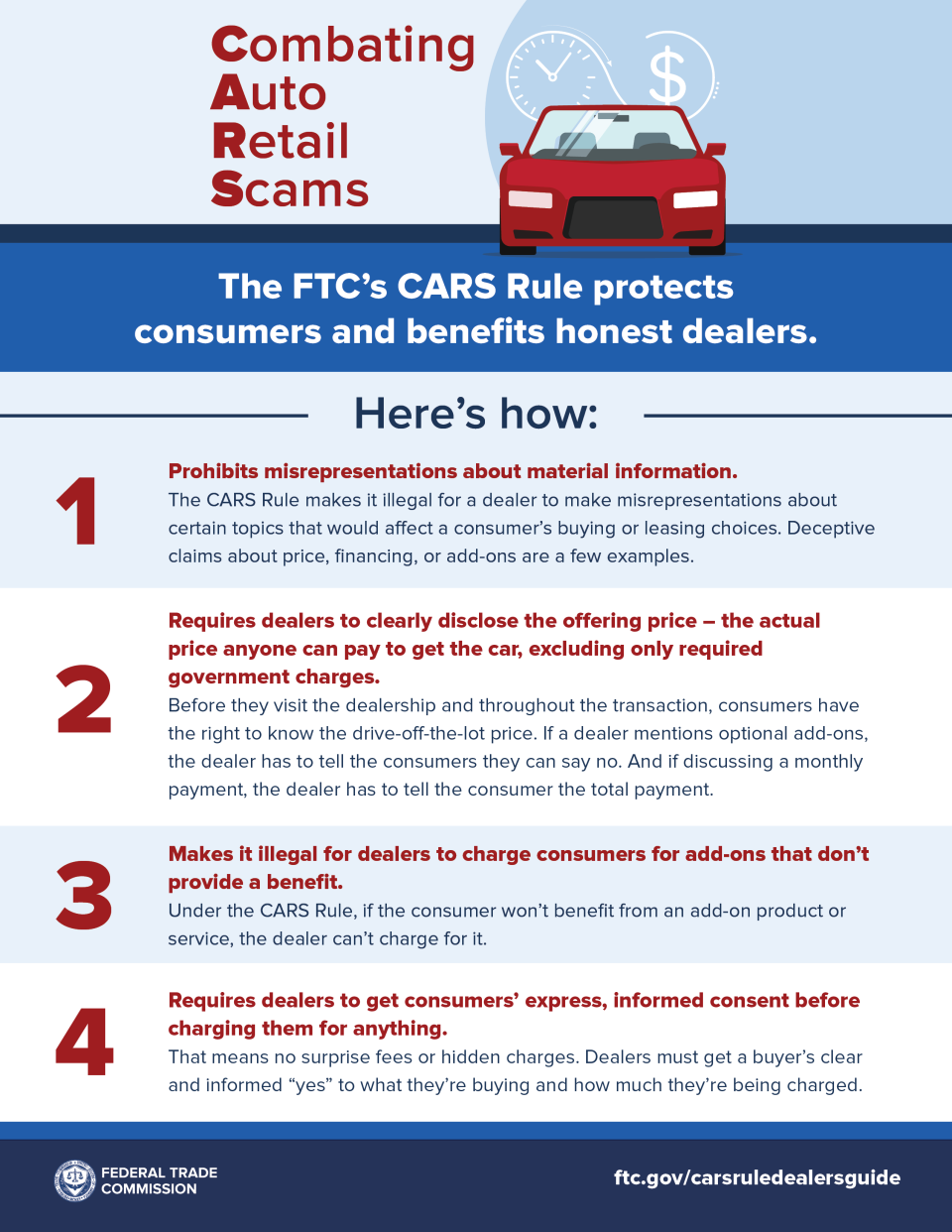

What are those bottom-line truth-in-car-buying principles? Here’s a summary of what the CARS Rule does:

- The CARS Rule prohibits misrepresentations about material information.

- The CARS Rule requires dealers to clearly disclose the offering price – the actual price anyone can pay to get the car, excluding only required government charges. Before they visit the dealership and throughout the transaction, consumers have the right to know the drive-off-the-lot price. If a dealer mentions optional add-ons, the dealer has to tell the consumer they can say no. And if discussing a monthly payment, the dealer has to tell the consumer the total payment.

- The CARS Rule makes it illegal for dealers to charge consumers for add-ons that don’t provide a benefit.

- The CARS Rule requires dealers to get consumers’ express, informed consent before charging them for anything.

Read on for specifics about the across-the-board principles that all dealers must abide by.

1. The CARS Rule prohibits misrepresentations about material information.

A key part of the CARS Rule is a prohibition on misrepresentations about certain categories of information that are material to consumers when shopping for a car. What does “material” mean in this context? The Rule defines it in the same way the FTC has for decades: information “likely to affect a person’s choice of, or conduct regarding, goods or services.” And stating a long-standing principle that applies to all other businesses, the Rule prohibits both express and implied misrepresentations.

To put some industry specifics on the prohibition on material misrepresentations, the CARS Rule lists a number of practices that violate both the Rule and Section 5 of the FTC Act’s ban on deceptive and unfair practices. More specifically, it’s illegal for dealers to make misrepresentations about material information in all of these categories:

a. The costs or terms of buying, financing, or leasing a vehicle;

b. Any costs, limitation, benefit, or any other aspect of an add-on product or service;

c. Whether the terms are, or transaction is, for financing or a lease;

d. The availability of any rebates or discounts that are factored into the advertised price but not available to all consumers;

e. The availability of vehicles at an advertised price;

f. Whether any consumer has been or will be preapproved or guaranteed for any product, service, or term;

g. Any information on or about a consumer’s application for financing;

h. When the transaction is final or binding on all parties;

i. Keeping cash down payments or trade-in vehicles, charging fees, or initiating legal process or any action if a transaction isn’t finalized or if the consumer doesn’t wish to go forward with a transaction;

j. Whether or when a dealer will pay off some or all of the financing or lease on a consumer’s trade-in vehicle;

k. Whether consumer reviews or ratings are unbiased, independent, or ordinary consumer reviews or ratings of the dealer or the dealer’s products or services;

l. Whether the dealer or any of the dealer’s personnel or products or services is or was affiliated with, endorsed or approved by, or otherwise associated with the United States government or any federal, state, or local government agency, unit, or department, including the Department of Defense or any branch of the military;

m. Whether consumers have won a prize or sweepstakes;

n. Whether, or under what circumstances, a vehicle may be moved, including across state lines or out of the country;

o. Whether, or under what circumstances, a vehicle may be repossessed; and

p. Any of the disclosures required by the Rule.

2. The CARS Rule requires dealers to clearly disclose the offering price – the actual price any consumer can pay to get the car, excluding only required government charges.

Two particular concerns consumers have expressed about the car shopping process are the use of bait-and-switch tactics and hidden charges – practices that make it tough for consumers to figure out the actual price they’ll have to pay and what they’re actually paying for. The CARS Rule seeks to remedy that problem by requiring dealers to disclose certain important facts about the deal, including the offering price, clearly and conspicuously. (This Dealers Guide includes more information about making clear and conspicuous disclosures.)

Here are disclosures the CARS Rule requires dealers to make clearly and conspicuously:

- The offering price. In connection with the sale or financing of vehicles, dealers must clearly disclose the offering price, defined in the CARS Rule as the full cash price for which the dealer will sell or finance the vehicle to any consumer. The only costs that can be excluded from the offering price are required government charges – for example, taxes, license and registration costs, or inspection or certification fees. The Rule specifies three circumstances where the dealer must clearly disclose the offering price

- In any ad that references, expressly or by implication, a specific vehicle;

- In any ad that represents, expressly or by implication, any monetary amount or financing term for any vehicle; and

- In any communication with a consumer that refers, expressly or by implication, to a specific vehicle or to any monetary amount or financing term. In its first response to a consumer, the dealer must clearly disclose the offering price. If the communication or response is in writing, the offering price must be disclosed in writing.

- The fact that add-ons aren’t required. When making any representation, expressly or by implication, about an add-on product or service, the dealer must clearly disclose that the add-on isn’t required and that the consumer can buy or lease the vehicle without the add-on, if that’s the case. If the dealer makes the representation in writing, the disclosure must be in writing, too. As explained further in this Dealers Guide, the Rule includes other important provisions prohibiting dealers from charging consumer for add‑ons that don’t offer consumers a benefit.

- The total of payments for a financed or lease transaction. When making any representation, expressly or by implication, about a monthly payment for a vehicle, the dealer must clearly disclose the total amount the consumer will pay after making all payments as scheduled. If the dealer makes the representation in writing, the disclosure must be in writing, too. If the total amount assumes the consumer will provide consideration – for example, a cash down payment or a trade-in – the dealer must clearly disclose the amount of consideration the consumer must provide. If the dealer makes the representation in writing, the disclosure must be in writing, too.

- Monthly payments comparison. If a dealer makes any express or implied comparison between payment options that includes a discussion of a lower monthly payment, the dealer must clearly disclose that the lower monthly payment will increase the total amount the consumer will pay to buy or lease the vehicle, if that’s the case. If the dealer makes the representation in writing, the disclosure must be in writing, too.

3. The CARS Rule makes it illegal to charge consumers for add-ons that don’t provide a benefit.

In commenting about the CARS Rule, consumers and some dealers expressed concern that unscrupulous dealers deceptively include add-on products or services in the transaction, or charge consumers for surprise items. The Rule defines an add-on as any product or service not provided to the consumer or installed by the manufacturer that the dealer, directly or indirectly, charges the consumer for. A particularly harmful practice is when those add-ons don’t offer consumers a benefit.

Under the CARS Rule, a dealer may not charge for an add-on product or service if the consumer wouldn’t benefit from it. Examples include charges for “nitrogen-filled tires” that contain no more nitrogen that naturally exists in the air. Other examples are add-ons that don’t provide coverage for the vehicle, the consumer, or the transaction, or are duplicative of the car’s warranty coverage. It would be illegal for a dealer to charge consumers for a GAP Agreement – a term the CARS Rule defines – if the consumer’s vehicle or neighborhood is excluded from coverage or the loan-to-value ratio means the consumer won’t benefit financially from the product or service.

4. The CARS Rule requires dealers to get consumers’ express, informed consent before charging them for anything.

Under the CARS Rule, dealers must get consumers’ express, informed consent before charging them for anything. Period. The Rule explains that express, informed consent means an affirmative act communicating unambiguous assent to be charged, made after receiving clear and conspicuous disclosures of: (1) what the charge is for; and (2) the amount of the charge, including, if the charge is for a product or service, all fees and costs the consumer will be charged over the period of repayment with and without the product or service. Under the CARS Rule, the consumer’s consent must be in close proximity to when and where the dealer makes the clear disclosures. This information must be conveyed in writing, and also orally for in-person transactions.

Comments from consumers and the FTC’s law enforcement experience in challenging illegal conduct by certain dealers point to some practices that subvert express, informed consent – for example, a signed or initialed document, by itself; a prechecked box; or an agreement obtained through any practice that has the effect of impairing consumers’ autonomy, decision‑making, or choice. The CARS Rule simply states that a basic tenet of consumer protection law – that consumers have a right to know in advance what they’ll be charged and must give an unambiguous and fully informed “yes” before the business can charge them – applies with full force in the car buying or leasing process. Dealers who do these things – and keep records showing they did – are complying with that part of the CARS Rule.

Answers to questions dealers may have about the CARS Rule

What is the FTC’s legal authority for enacting the CARS Rule?

The Dodd-Frank Act gives the FTC authority to make rules about unfair or deceptive dealer practices. The FTC announced a Notice of Proposed Rulemaking in 2022 to address unfair or deceptive practices in motor vehicle sales or leasing and received thousands of public comments from dealers, industry associations, consumer and community groups, federal and state agencies, and other people interested in the car buying process. The CARS Rule’s Statement of Basis and Purpose discusses what many of those commenters had to say.

Who’s covered by the CARS Rule?

The CARS Rule applies to Covered Motor Vehicle Dealers, defined as any person or business in the United States or a U.S. territory: 1) licensed by a state, the District of Columbia, or a territory to engage in the sale of Covered Motor Vehicles; 2) that takes title to, holds an ownership interest in, or takes physical custody of covered motor vehicles; and 3) is predominantly engaged in the sale and servicing of covered motor vehicles, their leasing and servicing, or both.

What kind of vehicles are covered by the CARS Rule?

The Rule applies to any Covered Motor Vehicle, which the Rule defines as any self-propelled vehicle designed for transporting people or property on public streets. In other words, the Rule applies to the advertising, sale, or leasing of automobiles, including cars, trucks, and SUVs. The CARS Rule’s definition of “motor vehicle” doesn’t include recreational boats and marine equipment; motorcycles, scooters, and electric bicycles; motor homes, recreational vehicle trailers, and slide‑in campers; or golf carts.

What kinds of communications does the CARS Rule apply to?

The provisions of the CARS Rule apply to all means that dealers use to communicate with prospective car buyers and lessees. To name just some examples, that includes television and radio ads, print ads, direct mail, websites, social media, ads streamed online, and oral statements conveyed to consumers.

What does the CARS Rule mean by “clearly and conspicuously”?

Under FTC law – and as defined in the CARS Rule – “clearly and conspicuously” refers to a disclosure made in a way that’s easy for consumers to understand and difficult for them to miss. Rather than mandating specific fonts or type sizes, the CARS Rule is results-oriented. It gives dealers the flexibility to determine the best way to meet the Rule’s requirements for their consumers under the circumstances, and includes some basic standards to apply:

- Ads in one modality. If an ad or other communication is solely visual or solely audible – what advertising professionals sometimes call “one modality” – the disclosure must be made in that same way. In other words, if an ad is solely visual, the disclosure must be made visually, too.

- Ads that are both visual and audible. If an ad or other communication is both visual and audible – for example, a TV ad – the disclosure must be presented at the same time in both the visual and audible portions of the ad. That standard applies even if the claim requiring the disclosure is made just visually or just audibly.

- Visual disclosures. Fine print, dense blocks of text, or language hidden where consumers aren’t likely to see it won’t meet the FTC’s “clear and conspicuous” standard. A visual disclosure must stand out from any accompanying text or other visual elements so that it’s easy for consumers to notice, read, and understand. In considering a visual disclosure, keep in mind – among other things – how big it is, how well it contrasts with the background, whether the disclosure is located where consumers will easily see it, and how long it appears the screen.

- Audible disclosures. We’ve all heard fast-talking disclosures often at the end of ads that are hard to follow. Those won’t do under the CARS Rule. An audible disclosure – for example, on radio, by telephone, or in streaming video – must be delivered in a volume, speed, and cadence sufficient for ordinary consumers to easily hear it and understand what it means.

- Interactive electronic media. For ads or other communications conveyed through an interactive electronic media – say, the internet or software – the disclosure must be unavoidable.

- Wording of disclosures. Disclosures must use words and grammar understandable to ordinary consumers. The Rule puts a premium on plain language. Legalese, jargon, or fancy double-talk won’t meet that standard. What’s more, disclosures must appear in each language in which the representation that requires the disclosure appears. (This Guide has more information about transactions in languages other than English.) Furthermore, other statements in the ad or communication can’t contradict or be inconsistent with the disclosure.

How do I know if I’m making disclosures clearly and conspicuously?

The CARS Rule’s definition of “clearly and conspicuously” and the advice in this Dealers Guide are good places to start. But a rule of thumb applied by honest advertisers – including car dealers – is to apply the same principles to disclosures that you use when crafting your own marketing materials. When you want consumers to sit up and take notice, you use big print, a clear font, eye-catching color, a contrasting background, and other design tools. You convey the information in a place consumers are sure to notice and in a way that’s impossible for them to miss. You use plain language that’s easy for consumers to understand. Think of it this way: How would you convey the information if you really wanted to reach your customers, rather than because you’re complying with a regulation? Dealers who think of disclosures with that frame of mind are more likely to earn consumers’ trust and avoid law enforcement consequences.

Does the CARS Rule apply to advertising and transactions in languages other than English?

Yes. Many dealers advertise, talk to car shoppers, and negotiate transactions in languages other than English. The CARS Rule’s standards for truth and transparency apply across the board, regardless of the language the car shopper and the dealer may use. For example, the CARS Rule requires that for disclosures to meet the definition of “clear and conspicuous,” the disclosure must be “easily understandable.” If a dealer makes a disclosure in a language the consumer doesn’t understand – and the content of the disclosure isn’t otherwise clearly understood by the consumer – the disclosure wouldn’t meet that requirement.

That standard also applies under the CARS Rule’s definition of express, informed consent, which requires consumers to “unambiguously assent” to charges. Consumers can’t unambiguously assent to something they don’t understand. Furthermore, the “clear and conspicuous” definition specifies that a disclosure “must appear in each language in which the representation that requires the disclosure appears.” (In this context, “appear” doesn’t just refer to visual disclosures. It applies to oral disclosures, too.) That means that if the practice that makes the disclosure necessary is made in a language other than English, the dealer must make the corresponding disclosure in that language. For example, if a dealer refers to an optional add-on in Spanish, the corresponding disclosure that the consumer can buy or lease the vehicle without the add-on must also be in Spanish. Dealers should be aware of the FTC’s long-standing Requirements concerning clear and conspicuous disclosures in foreign language advertising and sales materials, an Enforcement Policy Statement in place since 1973 and updated in 1998. To the extent that dealers engage in practices inconsistent with that Enforcement Policy Statement, they risk law enforcement action.

What if a car buyer agrees to waive their protections under the CARS Rule?

The Rule expressly prohibits that. In fact, it’s a violation of the CARS Rule for anyone to obtain – or even attempt to obtain – a waiver from a consumer of any protection or right the Rule extends to them.

Does the CARS Rule include provisions about retaining records?

Yes. The CARS Rule includes recordkeeping requirements, which follow what many dealers are already doing. The recordkeeping procedures have the added benefit of protecting dealers if concerns are raised after the fact about their practices.

Under the CARS Rule, dealers must create and retain for at least 24 months all records necessary to demonstrate their compliance with the Rule. The 24 months is calculated from the date the record was created. That includes the following documents:

- Ads. Dealers must retain copies of all materially different ads, sales scripts, training materials, and marketing materials about the price, financing, or lease of a vehicle, that the dealer disseminated during the relevant time period. (If a dealer uses a credit or lease ad that includes different vehicles or different amounts for the same credit or lease terms, it’s OK to retain an example, assuming that ads aren’t otherwise materially different.)

- Purchase orders and financing and leasing documents. Dealers must retain copies of all purchase orders and financing and leasing documents signed by the consumer, whether or not final approval was received for financing or leasing. This provision also covers all written communications about sales, financing, or leasing between the dealer and any consumers who signs a purchase order or financing or lease contract.

- Documents about add-ons. Dealers must retain records demonstrating that add-ons in consumer contracts meet the requirements of the CARS Rule. That includes copies of all service contracts, GAP Agreements, and calculations of loan-to-value ratios in contracts including GAP Agreements.

- Consumer complaints. Dealers must retain copies of all written consumer complaints about sales, financing, or leasing; consumer inquiries related to add-ons; and inquiries and responses about disclosures required by the Rule.

Dealers may keep required records in any legible form, and in the same manner, format, or place as they may already keep those records in the ordinary course of business. Failure to keep all required records is a violation of the CARS Rule.

What’s the penalty for violating the CARS Rule?

The violation of any FTC Trade Regulation Rule – including the CARS Rule – could result in provisions that will require a company to change how it does business going forward, to give money back to injured consumers, and to pay civil penalties of as much as $50,120 per violation.

How does the FTC’s CARS Rule interact with state laws?

The CARS Rule doesn’t change or supersede any state law or regulation unless the state standard is inconsistent with the FTC Rule. In that case, the CARS Rule will apply. But here’s an important caveat: If a state law or regulation gives consumer greater protections, the FTC doesn’t consider that to be inconsistent and residents of that state will get the greater protections their state law gives them.

When does the CARS Rule take effect?

The effective date of the CARS Rule has been paused pending judicial review.

Where can dealers go to get more information about complying with federal consumer protection laws?

The FTC’s Automobiles page features additional resources about complying with the law. Savvy business people also follow FTC law enforcement actions that could impact their industry. The FTC Business Blog publishes to-the-point recaps of FTC cases and initiatives, including ones relevant to car dealers. Subscribe to get Business Alerts delivered directly to your emailbox.

Glossary

Here is how the CARS Rule defines certain key terms.

Add-on or Add-on Product(s) or Service(s) means any product(s) or service(s) not provided to the consumer or installed on the Vehicle by the Vehicle manufacturer and for which the Dealer, directly or indirectly, charges a consumer in connection with a Vehicle sale, lease, or financing transaction.

Clear(ly) and Conspicuously means in a manner that is difficult to miss (i.e., easily noticeable) and easily understandable, including in all of the following ways:

- In any communication that is solely visual or solely audible, the disclosure must be made through the same means through which the communication is presented. In any communication made through both visual and audible means, such as a television advertisement, the disclosure must be presented simultaneously in both the visual and audible portions of the communication even if the representation requiring the disclosure is made in only one means.

- A visual disclosure, by its size, contrast, location, the length of time it appears, and other characteristics, must stand out from any accompanying text or other visual elements so that it is easily noticed, read, and understood.

- An audible disclosure, including by telephone or streaming video, must be delivered in a volume, speed, and cadence sufficient for ordinary consumers to easily hear and understand it.

- In any communication using an interactive electronic medium, such as the Internet or software, the disclosure must be unavoidable.

- The disclosure must use diction and syntax understandable to ordinary consumers and must appear in each language in which the representation that requires the disclosure appears.

- The disclosure must comply with these requirements in each medium through which it is received.

- The disclosure must not be contradicted or mitigated by, or inconsistent with, anything else in the communication.

Covered Motor Vehicle or Vehicle means any self-propelled vehicle designed for transporting persons or property on a public street, highway, or road. For purposes of this part, the term Covered Motor Vehicle does not include the following: (1) Recreational boats and marine equipment; (2) Motorcycles, scooters, and electric bicycles; (3) Motor homes, recreational vehicle trailers, and slide-in campers; or (4) Golf carts.

Covered Motor Vehicle Dealer or Dealer means any person, including any individual or entity, or resident in the United States, or any territory of the United States, that: (1) Is licensed by a State, a territory of the United States, or the District of Columbia to engage in the sale of Covered Motor Vehicles; (2) Takes title to, holds an ownership interest in, or takes physical custody of Covered Motor Vehicles; and (3) Is predominantly engaged in the sale and servicing of Covered Motor Vehicles, the leasing and servicing of Covered Motor Vehicles, or both.

Express, Informed Consent means an affirmative act communicating unambiguous assent to be charged, made after receiving and in close proximity to a Clear and Conspicuous disclosure, in writing, and also orally for in-person transactions, of the following: (1) What the charge is for; and (2) The amount of the charge, including, if the charge is for a product or service, all fees and costs to be charged to the consumer over the period of repayment with and without the product or service. The following are examples of what does not constitute Express, Informed Consent: (i) A signed or initialed document, by itself; (ii) Prechecked boxes; or (iii) An agreement obtained through any practice designed or manipulated with the substantial effect of subverting or impairing user autonomy, decision-making, or choice.

GAP Agreement means an agreement to indemnify a Vehicle purchaser or lessee for any of the difference between the actual cash value of the Vehicle in the event of an unrecovered theft or total loss and the amount owed on the Vehicle pursuant to the terms of a loan, lease agreement, or installment sales contract used to purchase or lease the Vehicle, or to waive the unpaid difference between money received from the purchaser’s or lessee’s Vehicle insurer and some or all of the amount owed on the Vehicle at the time of the unrecovered theft or total loss, including products or services otherwise titled “Guaranteed Automobile Protection Agreement,” “Guaranteed Asset Protection Agreement,” “GAP insurance,” or “GAP Waiver.”

Government Charges means all fees or charges imposed by a Federal, State, or local government agency, unit, or department, including taxes, license and registration costs, inspection or certification costs, and any other such fees or charges.

Material or Materially means likely to affect a person’s choice of, or conduct regarding, goods or services.

Offering Price means the full cash price for which a Dealer will sell or finance the Vehicle to any consumer, provided that the Dealer may exclude only required Government Charges.

[Note: Updated on January 24, 2024, to remove the Rule’s effective date, pending judicial review.]